Yield to maturity formula excel 175296-How to calculate yield to maturity in excel

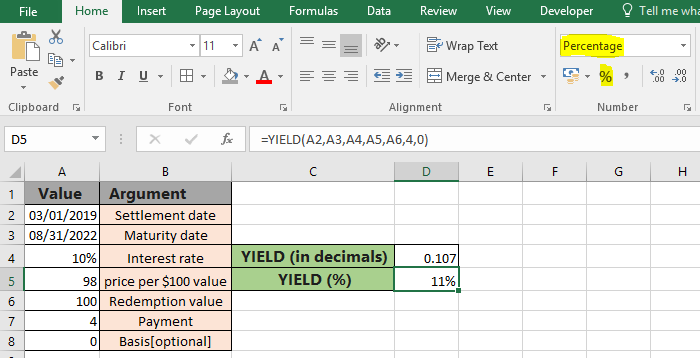

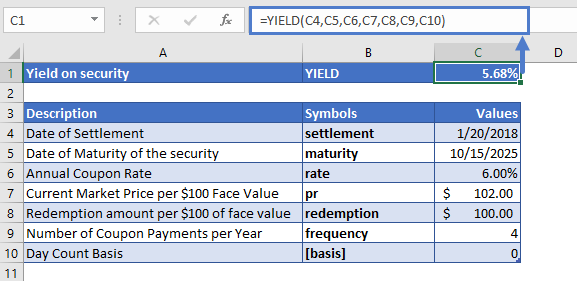

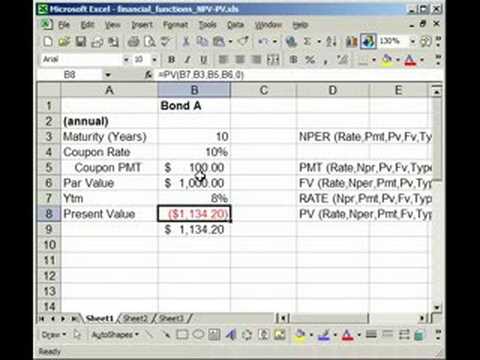

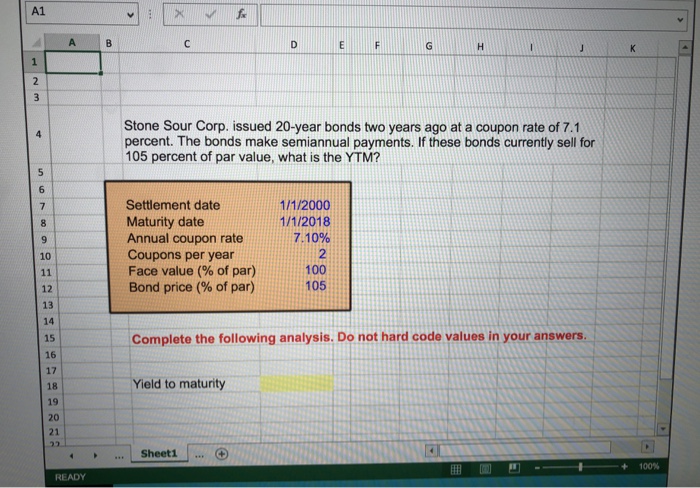

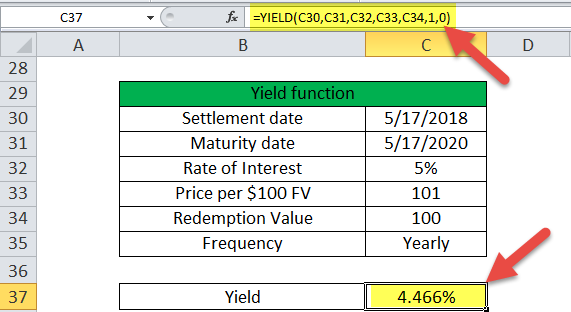

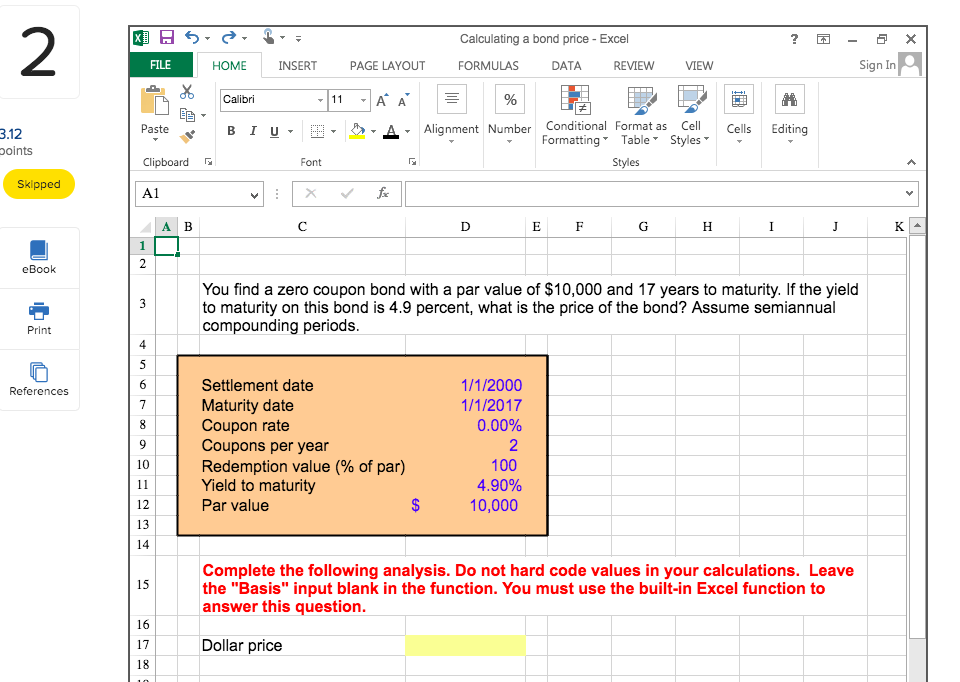

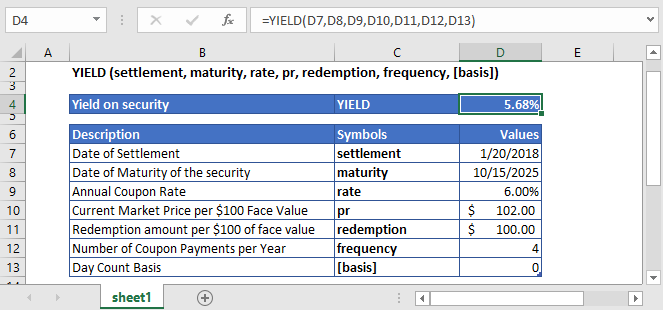

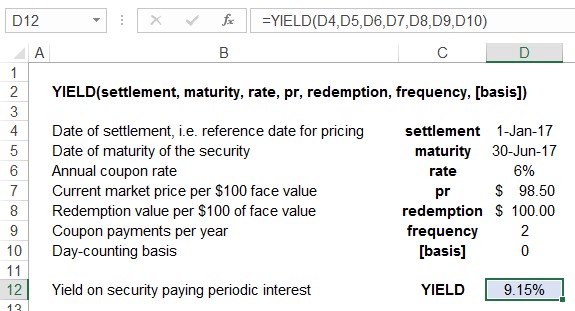

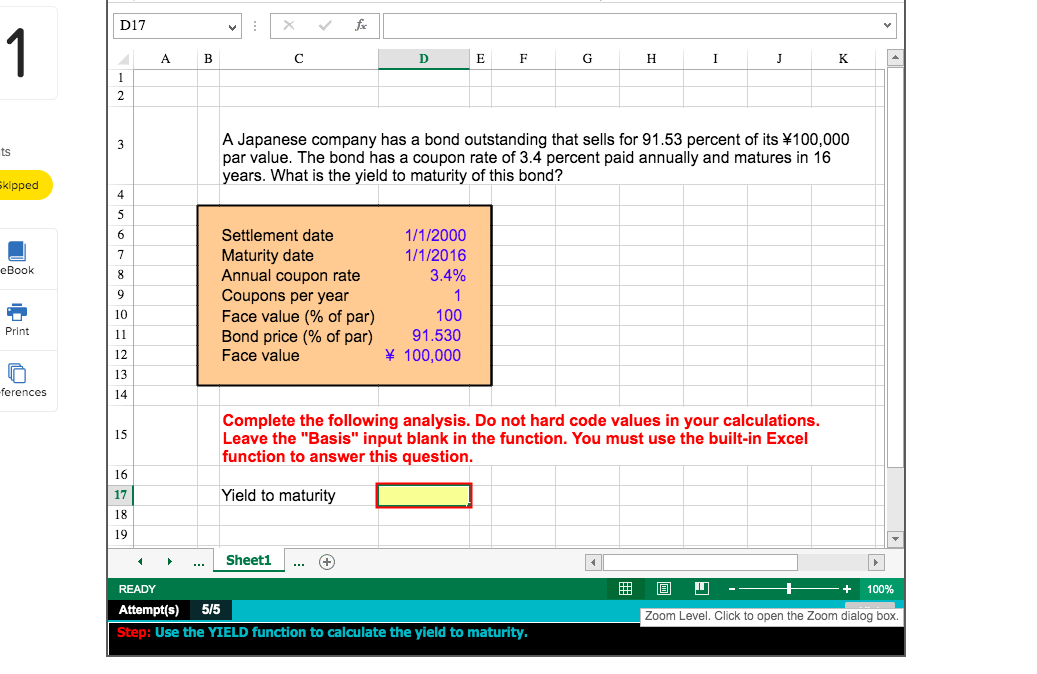

From here, you will already see the value upon maturity and you will be able to identify the yield at maturity Computation when the steps are followed is relatively simply If you still find it complicated, then you can get help from the excel wizard which will make the process easier for you to understandThe formula used to calculate the Yield is =YIELD(C4,C5,C6,C7,C8,C9,C10) The YIELD function calculates the yield of the 10year bond YIELD = % As recommended the values of the settlement and maturity date arguments are entered as a reference to the cells containing datesI'm looking for a formula that gives me the current yield to maturity (YTM) for a bond, that takes into account the frequency of coupon (Monthly, SemiAnnual or Annual) and the effect of compound interest For example A1 = Today () B1 = Maturity Date C1 = Coupon (M, S, A) D1 = Present Value

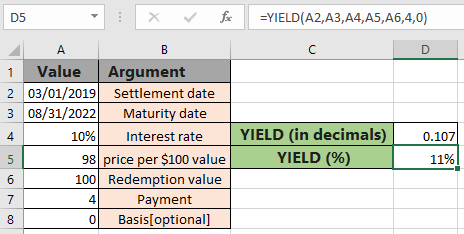

How To Use The Yield Function In Excel

How to calculate yield to maturity in excel

How to calculate yield to maturity in excel-S Spurious Active Member Joined Dec 14, 10 Messages 439 Mar 29, 11 #1 Hello guys, I dont want to use regular Excel Thanks in advance Some videos you may like Excel Facts Did you know Excel offers Filter by Selection?You can use the YIELD function to calculate this in Excel =YIELD(Settlement Date, Maturity Date, Coupon Rate, Bond Price % Par Value Out of the Number 100, 100, Coupon Frequency) For example, if you buy a 5% bond for 9623% of its par value on December 31, 14, and hold it until its maturity on December 31, 24, you could enter

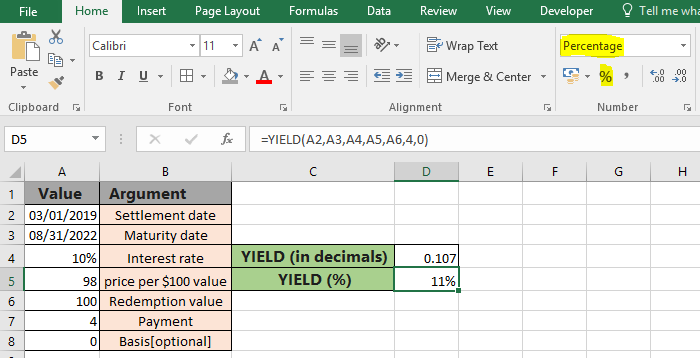

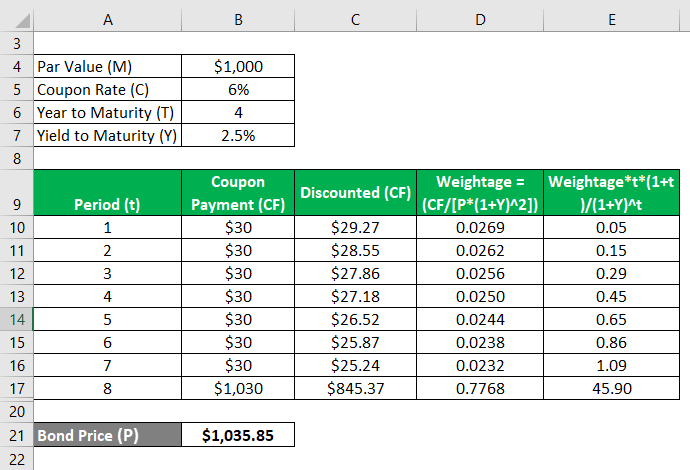

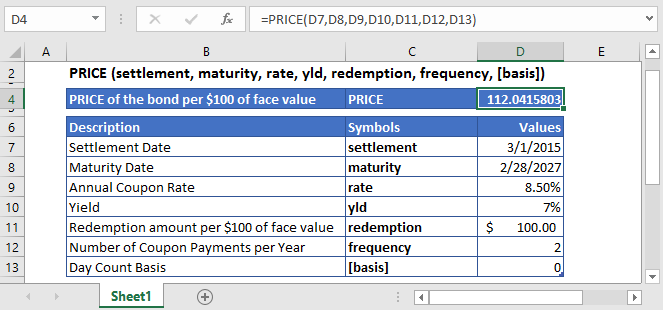

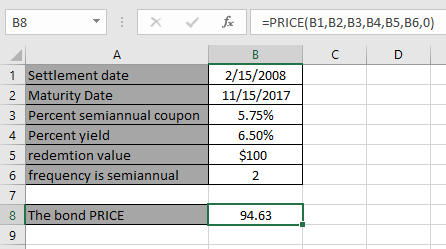

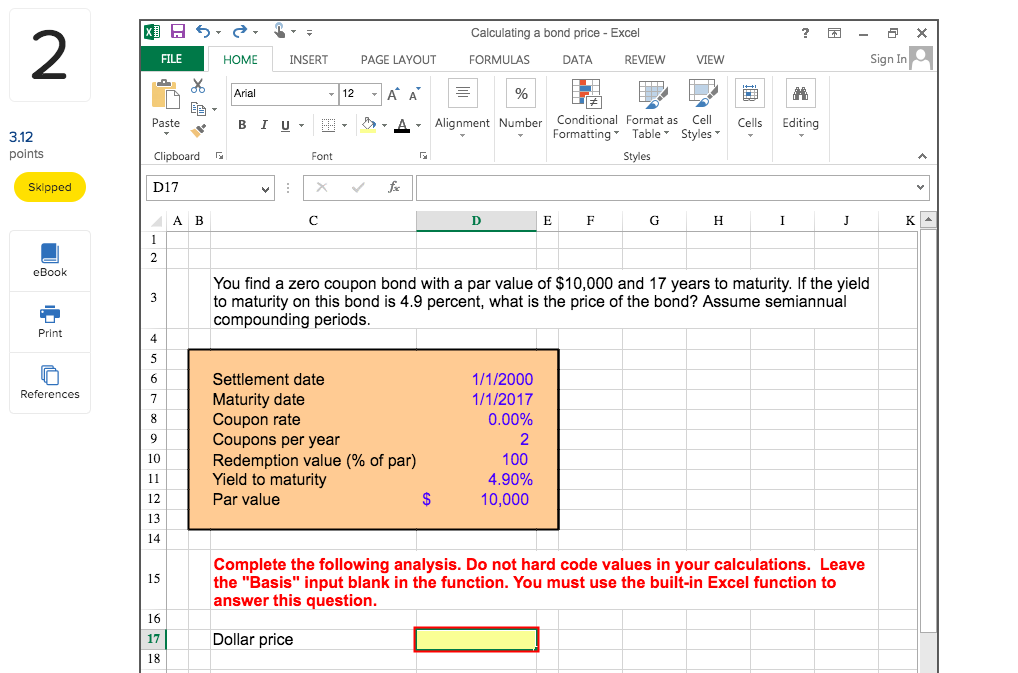

How To Calculate Bond Price In Excel

Maturity Value Formula Maturity, as its name suggests, is the date on which the final payment for the financial instrument like a bond, etc happens and there is no more payment which aMy school book shows that the yield to maturity = dollar amount of annual interest face value market value / the number of period of times which = market value face vale / 2 = 60 1000 900 / 10 which again = 900 1000 / 2 which equals 0074 or 7 4 I have no idea where the number 2 comes from, and why it is usedStart date Mar 29, 11;

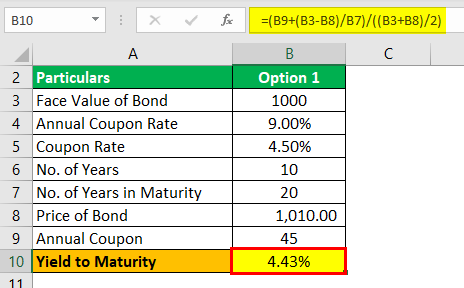

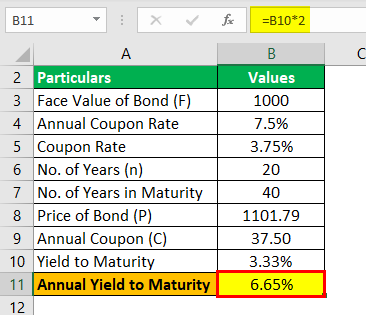

Examples of Maturity Value Formula (With Excel Template) Maturity Value Formula Calculator;Use the Yield Function to Calculate the Answer Type the formula "=Yield (B1,B2,,B4,B5,B6,)" into cell B8 and hit the "Enter" key The result should be percentwhich is the annual yield to maturity of this bondYield to Maturity (YTM) Formula Excel Template Prepared by Dheeraj Vaidya, CFA, FRM visit email protected Particulars Values Face Value of Bond (F) 1000 Annual Coupon Rate 8% No of years in Maturity (n) 12 Price of the Bond (P) 940 Annual Coupon (C) 8000 Yield to Maturity 876% Assume that the price of the bond is $940 with the face value

Excel Yield Function Example The following example shows the Excel Yield function used to calculate the yield on a coupon purchased on 01Jan10, with Maturity date 30Jun15 and a rate of 10% The price per $100 face value is $101 and the redemption value is $100 Payments are made quarterly and the US (NASD) 30/360 day count basis is usedPlug the yield to maturity back into the formula to solve for P, the price Chances are, you will not arrive at the same value This is because this yield to maturity calculation is an estimate Decide whether you are satisfied with the estimate or if you need more precise informationAn example of finding the YTM (yield to maturity) of a bond using the =RATE formula in Excel

How To Use The Yield Function In Excel

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Create Yield To Maturity Formula In Vba Similar Topics Create Yield To Maturity Formula In Vba Excel View Answers Hello guys, I got a question regarding some financial maths I want to write a function in VBA that calculates the following C coupon F face value P priceYield to maturity formula is for calculating the bond based yield on its current market price rather than the straightforward yield which is discovered utilizing the profit yield equation To calculate yield to maturity, the bond price or bond's current value must already be knownYIELD is an Excel function that returns the yield to maturity of a bond given its coupon rate, current price, principal amount and coupon payment frequency per year In the context of debt securities, yield is the return that a debtholder earns by investing in a security at its current price

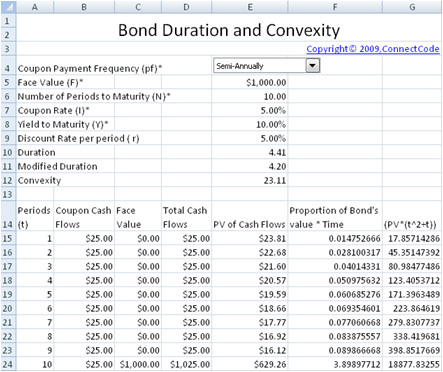

Convexity Formula Examples With Excel Template

Bond Key Rate Duration Krd In Excel Calculating And Understanding Resources

Maturity Value Formula (Table of Contents) Maturity Value Formula;Yield to Maturity (YTM) is the most commonly used and comprehensive measure of risk In fact, if someone talks about just 'Yield' they are most likely referring to Yield to Maturity In simple terms, YTM is the discount rate that makes the present value of the future bond payments (coupons and par) equal to the market price of the bond plusC How to calculate the Yield to Maturity (YTM) of a bond The equation below gives the value of a bond at time 0 The cash flows of the bond, coupon payments (CP) and Maturity Value (MV = Principal Amount Coupon payment) have been discounted at the yieldtomaturity (YTM) rate, r, in order to determine the present value of cash flows or alternatively the price or value of the bond (V Bond)

How To Calculate Bond Yield In Excel 7 Steps With Pictures

Bond Pricing Formula How To Calculate Bond Price

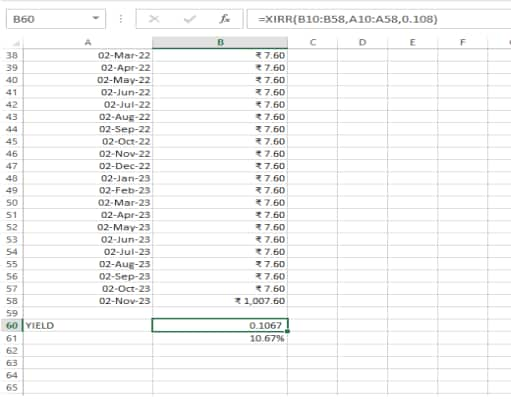

Maturity Value Formula Maturity, as its name suggests, is the date on which the final payment for the financial instrument like a bond, etc happens and there is no more payment which aTo solve this equation, you can use the IRR function of MS Excel as in the figure below Select output cell B4 Click fx button, select All category, and select IRR function from the list In field Values, select the data range B2F2, leave empty field Guess, and press the OK button Thus, the yield to maturity of the bond is 857%The term "yield to maturity" or YTM refers to the return expected from a bond over its entire investment period until maturity YTM is used in the calculation of bond price wherein all probable future cash flows (periodic coupon payments and par value on maturity) are discounted to present value on the basis of YTM

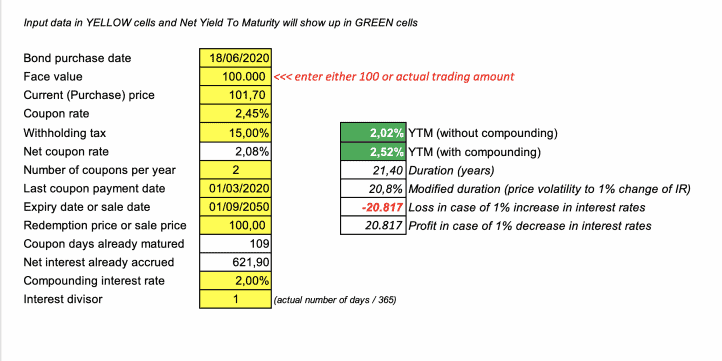

Bond Net Yield To Maturity Calculator Efinancialmodels

Calculating The Constant Yield Using Excel Gaap Logic

C How to calculate the Yield to Maturity (YTM) of a bond The equation below gives the value of a bond at time 0 The cash flows of the bond, coupon payments (CP) and Maturity Value (MV = Principal Amount Coupon payment) have been discounted at the yieldtomaturity (YTM) rate, r, in order to determine the present value of cash flows or alternatively the price or value of the bond (V Bond)As a worksheet function, YIELD can be entered as part of a formula in a cell of a worksheet To understand the uses of the function, let's consider anTo apply the yield to maturity formula, we need to define the face value, bond price and years to maturity For example, if you purchased a $1,000 for $900 The interest is 8 percent, and it will mature in 12 years, we will plugin the variables

How To Use The Excel Yieldmat Function Exceljet

Price Function Calculate Bond Price Excel Google Sheet Automate Excel

The formula for current yield is expressed as expected coupon payment of the bond in the next one year divided by its current market price Mathematically, it is represented as, Current Yield = Coupon Payment in Next One Year / Current Market Price * 100% Example of Bond Yield Formula (With Excel Template)Yield to Maturity (YTM) Formula Excel Template Prepared by Dheeraj Vaidya, CFA, FRM visit email protected Particulars Values Face Value of Bond (F) 1000 Annual Coupon Rate 8% No of years in Maturity (n) 12 Price of the Bond (P) 940 Annual Coupon (C) 8000 Yield to Maturity 876% Assume that the price of the bond is $940 with the face valueYield to Maturity Formula refers to the formula that is used in order to calculate total return which is anticipated on the bond in case the same is held till its maturity and as per the formula Yield to Maturity is calculated by subtracting the present value of security from face value of security, divide them by number of years for maturity and add them with coupon payment and after that dividing the resultant with sum of present value of security and face value of security divided by 2

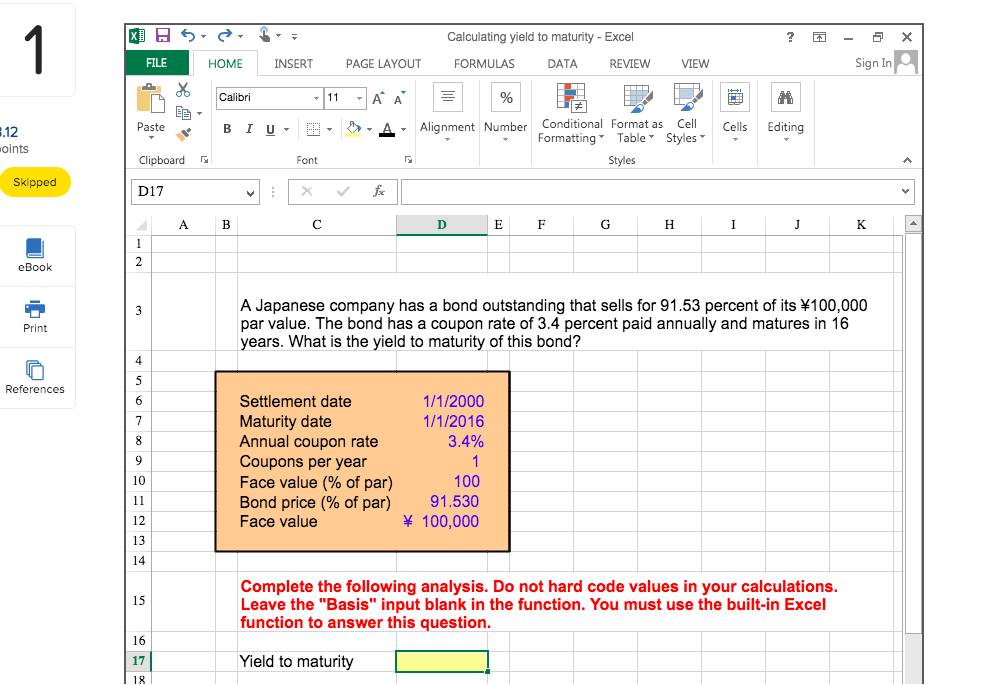

Solved X 5 X Home Calculating Yield To Maturity Exc Chegg Com

Excel Yield Function

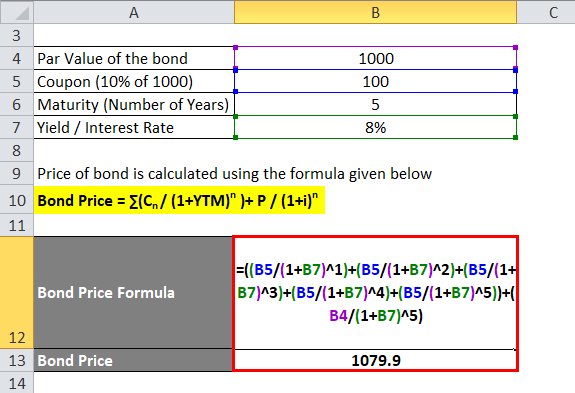

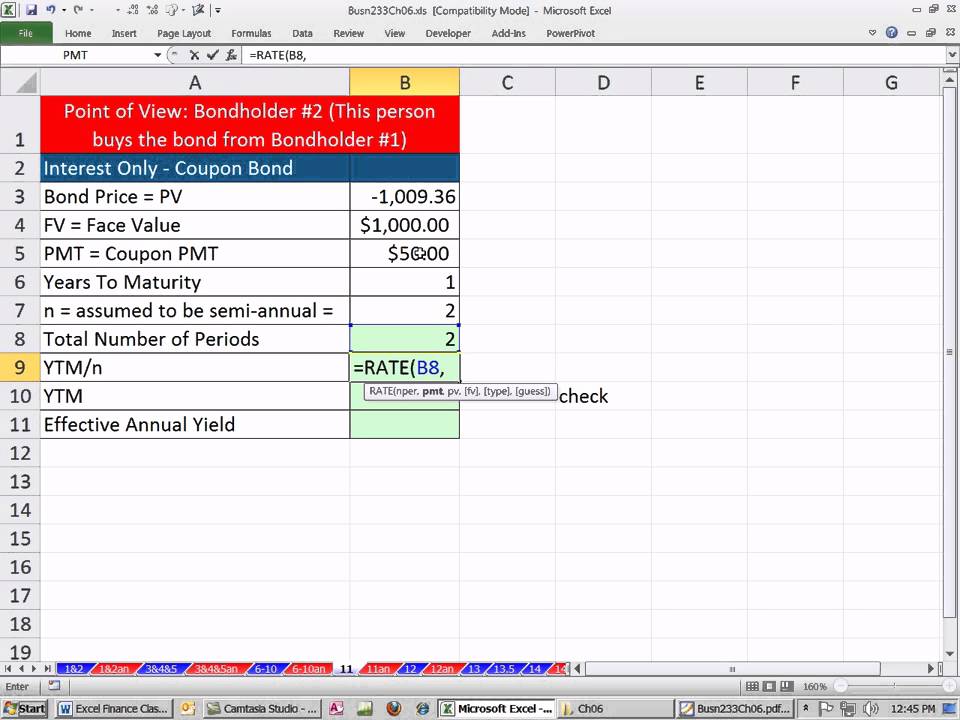

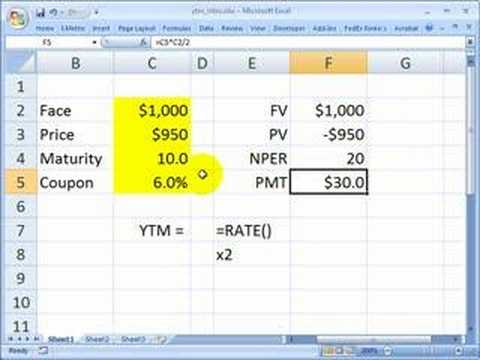

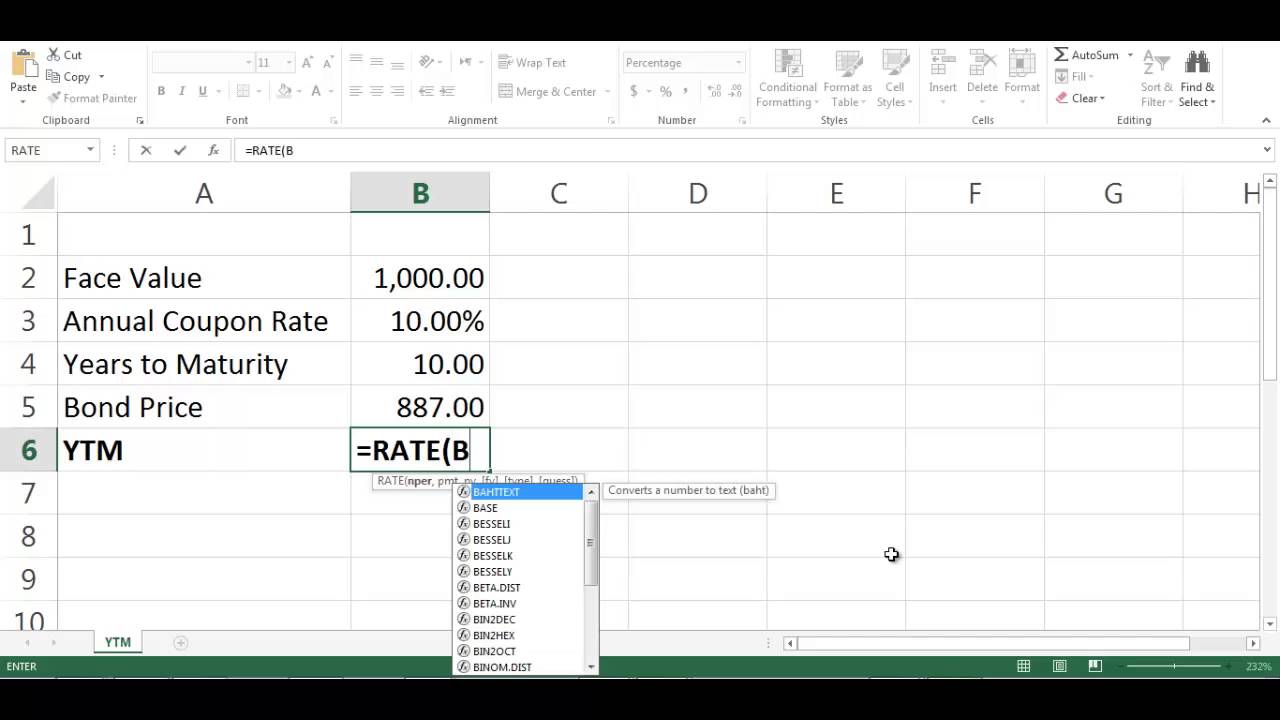

You can use Excel's RATE function to calculate the Yield to Maturity (YTM) Check out the image below The syntax of RATE function RATE (nper, pmt, pv, fv, type, guess)Formula Under the yield to maturity approach, cost of debt is calculated by solving the following equation for r There is no algebraic solution to the above equation, but we can employ the hitandtrial method We can also use Excel YIELD function Please see the article on YIELD TO MATURITY to study alternative methods for solving for rYield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments The YTM formula is used to calculate the bond's yield in terms of its current market price and looks at the effective yield of a bond based on compounding

Explained How To Calculate Yields On Your Bond Investments

Ytm Formula Excel

The YIELDMAT function returns the annual yield of a security that pays interest at maturity In the example shown, the formula in F5 is = YIELDMAT(C9, C7, C8, C6, C5, C10) with these inputs, the YIELDMAT function returns 0081 which, or 810% when formatted with the percentage number formatYield to Maturity (YTM) – otherwise referred to as redemption or book yield – is the speculative rate of return or interest rate of a fixedrate security, such as a bond The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has maturedThe bond yield formula is the formula used to calculate the return on bonds invested and is based on the purchase price and interest amount prescribed The interest amount prescribed is also known as the coupon rate The coupon rate is nothing but the amount mentioned for a certain payment, which is mandatory

Quant Bonds Between Coupon Dates

Bond Duration Formula Excel Example

From here, you will already see the value upon maturity and you will be able to identify the yield at maturity Computation when the steps are followed is relatively simply If you still find it complicated, then you can get help from the excel wizard which will make the process easier for you to understand/ Excel Formula for Yield to Maturity The YTM is easy to compute where the acquisition cost of a bond is at par and coupon payments are effected annually In such a situation, the yieldtomaturity will be equal to coupon payment However, for other cases, an approximate YTM can be found by using a bond yield tableWhat is the math formula to proof excel calculation 3426 as my example above Alternatively, note that the yield to maturity is the IRR of the cash flows So we might use the Excel RATE, IRR or XIRR function to convince ourselves that the YIELD function is returning the correct value Here is how Yatie wrote previously Face value 100

Yield To Maturity Ytm Overview Formula And Importance

How To Use The Excel Yield Function Exceljet

What is Bond Yield Formula?Excel Yieldmat Function Example In the following spreadsheet, the Excel Yieldmat function is used to calculate the annual yield for a security purchased on 01Jan17, with issue date 01Jul14 and maturity date 30Jun18 The interest rate at date of issue is 55% and the security has a price of $101 per $100 face valueFor semiannual coupons, apparently the YIELD function effectively multiplies the periodic YTM by 2 (Note that 2*IRR(A11) is indeed about %) I would disagree, based on timevalue principles However, the Excel YIELD function result agrees with the HP 12C result

Floating Rate Notes Frn In Excel Understanding Duration Discount Margin And Krd Resources

How To Calculate Spot Rates Forward Rates Ytm In Excel Financetrainingcourse Com

Dates returned from formulas How to use the YIELD Function in Excel?Maturity Value Formula (Table of Contents) Maturity Value Formula;Start date Mar 29, 11;

Excel Yield Function

How To Use The Yield Function In Excel

This article describes the formula syntax and usage of the YIELD function in Microsoft Excel Description Returns the yield on a security that pays periodic interest Use YIELD to calculate bond yield Syntax YIELD(settlement, maturity, rate, pr, redemption, frequency, basis)The Excel YIELD function is used to calculate bond yield to maturity Excel YIELD Function Example Suppose for example, the current price of a bond is Assuming that the 3 year bond was issued for settlement on 25 October 18 with a face value of 1,000, and coupon rate of 6% paid every 6 months The Excel YIELD to maturity function canIf the bond is held to maturity, five years of interest would produce a 2425% total yield Or, if the bond was called after two or four years, you would have a total yield of 97% or 194%

Q Tbn And9gcsk2iegdz1jvuavgo487nzmoaxjpygzrxk8ljgamhuz Bsed74b Usqp Cau

How To Calculate Spot Rates Forward Rates Ytm In Excel Financetrainingcourse Com

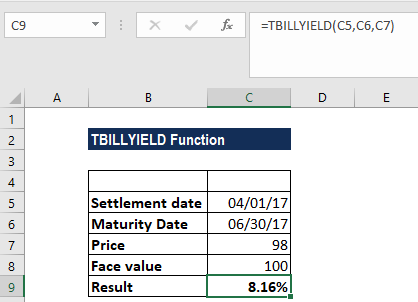

The Excel YIELDDISC function returns the annual yield for a discounted security, such as a Treasury bill, that is issued at a discount but that matures at face value Excel YIELDMAT Function The Excel YIELDMAT function returns the annual yield of a security that pays interest at maturityHow to use =Rate in MS Excel to calculate YTM for bondsS Spurious Active Member Joined Dec 14, 10 Messages 439 Mar 29, 11 #1 Hello guys, I dont want to use regular Excel Thanks in advance Some videos you may like Excel Facts Did you know Excel offers Filter by Selection?

Yield To Maturity Approximate Formula With Calculator

Vba To Calculate Yield To Maturity Of A Bond

Create Yield to maturity formula in VBA Thread starter Spurious;The settlement and maturity dates should be supplied to the YIELD function as either References to cells containing dates;Yield to maturity is calculated using the IRR function on a mathematical calculator or MS Excel Semiannual yield to maturity in this example is calculated by finding r in the following equation r comes out to be 115% Relevant annual before tax cost of debt is just the relevant APR which his 23% (2 × 115%)

How To Use The Price Function In Excel

Best Excel Tutorial How To Calculate Ytm

To calculate the current yield, click inside the cell B11 and enter the formula "= (B1*B2)/B9" (without double quotes) To calculate the yield to maturity, click inside the cell B12 Go to Formulas (main menu) > Financial (in the Function Library group) and select the RATE function You will get a window like thisExamples of Maturity Value Formula (With Excel Template) Maturity Value Formula Calculator;Create Yield to maturity formula in VBA Thread starter Spurious;

Free Bond Duration And Convexity Spreadsheet

Function Duration

The yield to maturity formula is used to calculate the yield on a bond based on its current price on the market The yield to maturity formula looks at the effective yield of a bond based on compounding as opposed to the simple yield which is found using the dividend yield formulaFrom here, you will already see the value upon maturity and you will be able to identify the yield at maturity Computation when the steps are followed is relatively simply If you still find it complicated, then you can get help from the excel wizard which will make the process easier for you to understandThe formula used to calculate the Yield is =YIELD(C4,C5,C6,C7,C8,C9,C10) The YIELD function calculates the yield of the 10year bond YIELD = % As recommended the values of the settlement and maturity date arguments are entered as a reference to the cells containing dates

Bond Yield To Maturity Calculator Exceltemplates Org

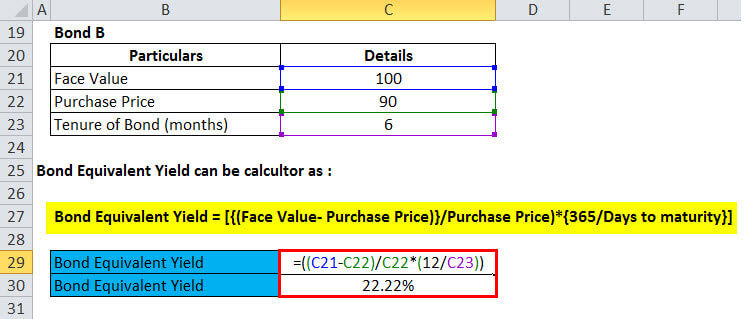

Bond Equivalent Yield Formula Calculator Excel Template

The formula to price a traditional bond is Calculating the Yield to Maturity in Excel The above examples break out each cash flow stream by year This is a sound method for most financialThis article describes the formula syntax and usage of the YIELD function in Microsoft Excel Description Returns the yield on a security that pays periodic interest Use YIELD to calculate bond yield Syntax YIELD(settlement, maturity, rate, pr, redemption, frequency, basis)My school book shows that the yield to maturity = dollar amount of annual interest face value market value / the number of period of times which = market value face vale / 2 = 60 1000 900 / 10 which again = 900 1000 / 2 which equals 0074 or 7 4 I have no idea where the number 2 comes from, and why it is used

Holding Period Return On Option Free Fixed Income Securities Excel Cfo

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

How To Calculate The Yield To Maturity Of A Bond Or Cd With Excel Youtube

Yield To Maturity Formula Step By Step Calculation With Examples

Free Bond Valuation Yield To Maturity Spreadsheet

Best Excel Tutorial How To Calculate Yield In Excel

Bond Yield Formula Calculator Example With Excel Template

Yield To Maturity Formula Step By Step Calculation With Examples

How To Calculate Yield To Maturity In Excel With Template Exceldemy

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

1

Bond Yield To Maturity Calculator Printer Driver Printer Batch File

Excel Finance Class 48 Calculate Ytm And Effective Annual Yield From Bond Cash Flows Rate Effect Youtube

Learn To Calculate Yield To Maturity In Ms Excel

Frm How To Get Yield To Maturity Ytm With Excel Ti Ba Ii Youtube

How To Calculate Bond Yield In Excel 7 Steps With Pictures

How To Use The Excel Tbillyield Function Exceljet

How To Calculate Ytm And Effective Annual Yield From Bond Cash Flows In Excel Microsoft Office Wonderhowto

Deriving The Bond Pricing Formula

How To Calculate Pv Of A Different Bond Type With Excel

Professional Bond Valuation And Yield To Maturity Spreadsheet

Compute The Current Bond Price Answer Must Be In Excel Formula Ninja Co Issued 14 Year Bonds Homeworklib

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

Zero Coupon Bond Yield Excel

Bond Yield To Maturity Calculator Exceltemplates Org

Bond Pricing Valuation Formulas And Functions In Excel Youtube

Excel Ytm Calculator Calculator Spreadsheet Free Download

Q Tbn And9gctacaieid4sboc7gfwy42ckuxutk9izg3v4wua1wzgqipvknrom Usqp Cau

What Is Yield To Maturity How To Calculate It Scripbox

Excel Yield Function Equivalent In Python Quantlib Quantitative Finance Stack Exchange

Best Excel Tutorial How To Calculate Yield In Excel

How To Calculate Bond Price In Excel

Yield To Maturity Formula Step By Step Calculation With Examples

Learn To Calculate Yield To Maturity In Ms Excel

How To Calculate Bond Price In Excel

Solved Calculate The Ytm Using Excel Formula And Cells S Chegg Com

Microsoft Excel Bond Valuation Tvmcalcs Com

Calculating The Annual Yield Of A Security That Pays Interest At Maturity Yieldmat

Yield Formula Excel Example

Bond Price Calculator Present Value Of Future Cashflows Dqydj

Duration Calculating The Annual Duration Of A Security

Calculating Bond S Yield To Maturity Using Excel Youtube

Best Excel Tutorial How To Calculate Ytm

How To Calculate Yield To Maturity 9 Steps With Pictures

Yield Function In Excel Calculate Yield In Excel With Examples

How To Use Mduration Function In Excel

Yield To Maturity Ytm Definition Formula Method Example Approximation Excel

Solved X 5 X Home Calculating Yield To Maturity Exc Chegg Com

Yield To Maturity Formula Step By Step Calculation With Examples

Debt Capital Market An Excel To Justify Your Bonus In Dcm Desk

Finding Yield To Maturity Using Excel Youtube

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

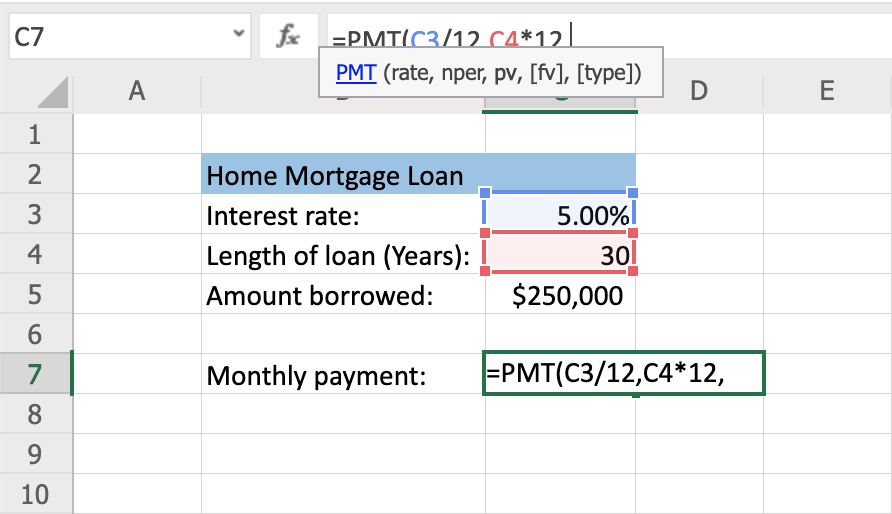

How To Calculate Monthly Loan Payments In Excel Investinganswers

3 Ways To Bootstrap Spot Rates For The Treasury Yield Curve Excel Cfo

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

Tbillyield Function Formula Examples Calculate Bond Yield

Yield To Maturity Calculation In Excel Example

Please Show Work In Excel Formula Thanks G A C E F N J 1 2 Union Local School District Has Bonds Outstanding With A Co Homeworklib

Professional Bond Valuation And Yield To Maturity Spreadsheet

How To Calculate Yield To Maturity In Excel With Template Exceldemy

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Yield To Maturity Ytm Calculator

Solved All Answers Must Be Entered As A Formula Click Ok Chegg Com

How To Calculate Bond Yield In Excel 7 Steps With Pictures

Excel Formula Help Evaluation Of A T Bill

How To Calculate Spot Rates Forward Rates Ytm In Excel Financetrainingcourse Com

Yield Function Formula Examples Calculate Yield In Excel

Solved All Answers Must Be Entered As A Formula Click Ok Chegg Com

How To Calculate Pv Of A Different Bond Type With Excel

Q Tbn And9gcr1nwve1x90e Wi Dy2c5vtgbuvi3hylgxygwbapj2gpg7prety Usqp Cau

How To Use The Excel Mduration Function Exceljet

コメント

コメントを投稿